Cow Dung Sticks, Credit Boom and Inflation

Troubled Galaxy Destroyed Dreams: Chapter 15

Palash Biswas

Community is disintegrated and disorganised. Market replaces with global village. New World Order has destroyed Nature and Man. only Consumers survive.

Recently, I was in a local train with my friends Dr. Mandhata Singh and Ram Bihari Singh. We were travelling by Barrackpur Majherhat local train in the evening.The compartment was full of daily passengers. We know many of them. Because Naihati Majherhat local has been diverted to Ballyganj route, the train is somewhat crowded.

While we reached Kolkata station, DR. Mandhata singh suggested that there should be Garibrath trains to link Banaras and Kathgodam.

I gently joked,` Dr saheb, you are suggesting to include extra two Rly ministers in Government of India. Without having Rly ministers from Banaras and Kath Godam, we may not get any new train from there. Laloo is too engaged with Bihar. Rambilas and Nitish kumar behaved the same way. it is high time we should get Rly minister either from Uttarakhand or Uttarpradesh. it would be better if we get two more.’

It was the beginning. It ignited the daily debate on economy and politics. We have to change the compartments time to time to avoid extra exposure.

The debate just began while Rambihari, a young journalist wanted suggestion on getting Credit Card. I was telling all about the hazards of credit system. Once you are trapped in, it would be rather difficult to seek escape route.

A credit card is a system of payment named after the small plastic card issued to users of the system. In the case of credit cards, the issuer lends money to the consumer (or the user) to be paid later to the merchant. It is different from a charge card, which requires the balance to be paid in full each month. In contrast, a credit card allows the consumer to 'revolve' their balance, at the cost of having interest charged. Most credit cards are issued by local banks or credit unions, and are the same shape and size, as specified by the ISO 7810 standard.

A co Passanger intervened before Dr Mandhata could add anything. He suggested, `Just get it.You may also opt for personal loan.’

Then he said,` you have not to pay. just change your rented apartment and throw away the SIM card of the mobile, no one would be able to locate you!’

I objected, ` It is a Salary Account’.

He replied, `Get the salary out of the account before the EMI cheques gets in.’

I tried to get hold of the situation and defended, ` Why, if the cheque is bounced, it would be a non bailable offence!’

He said, `Damn it. It is court order, the bank may not harass any consumer. If the cheque is bounced, you may state before the court that you are not in a position to pay. The credit is insured. Banks won`t lose anything. They won`t press for it’.

Dr Mandhata told,` Journalists, Rly, Police and Army personnel are blacklisted and they won`t get either Credit card or personal loan!’

He presented the immediate solution, `Just consult the agent. he has to get the commission. you may rig with your identity.’

He added, `Hire and Fire has helped the consumers a lot. Just Plus Twelve boys get high salary jobs in different companies, specially in sales. They have just the extra bit of technical training and never happens to be either moralist or ideologist. The job goes for a few month. They got the wanted pay slip. You may get any salary and any position in the payslip, if well managed. Just get one credit card. it will be followed by scores. Get the money and just vanish. Wipe out your identity and location. No one will be able to trace you out. it happens so many times in Metro Offices! Banks call on and call on. But no company has any clue about the dodging ex employee!’

Dr. Mandhata finished the topic that the market is so strong just because it is all about the credit. No cash!

It is clear. There is a strong flow of Money in the consumer market. People buy computer, TV, Refrigerator, etc financed and sale it for cash. They buy from the shopping Malls on credit and never care for the rates. they expand so much everywhere just because of the credit.

Thus, money is there without any contribution from the production system. Oil is the greatest cause for inflation true, but the credited money is also a big cause for the Inflation and Price rise!

My childhood knew the only energy source around. It was Cow Dung. For Hindus, the indigenous production system revolved around the sacred Cow. It was an infinite source of Energy. We got the bulls for the agriculture. We drank the milk. The urine was used to purify home. Cow dung was stored and used as most benevolent fertilizers.The women folk used Cow dung as cakes and sticks to run the stove in the kitchen. Edible oil was supplied from our own fields. We grew different kind of Oil seeds. Mustard mainly. We came to know kerosene for lighting lamp. This was the scene in any Indian Village even during sixties.

There was no world community to resist the war for Oil while USA attacked Iraq. After First Gulf War, USSR was disintegrated. Germany unified itself once again with the fall of the wall in berlin. Yugoslavia got partitioned. The geopolitics in east Europe changed. United States of America emerged as unipolar Imperialist state. The world forget the experience of Hiroshima and Nagasaki.It forgot Vietnam and the history of two world wars. Though, cry freedom was a grand success in south africa heralding the apartheid regime there.

With Dr Manmohan Singh, a world bank slave planted as a finance minister in Congress Government of India, then Prime minister Mr Narsimha Rao introduced the neo Liberal era with liberalisation, privatisation and globalisation. Before that India witnessed a Holocaust as anti Sikh riots highlighted in Operation Blue star which was followed by the Resurrection of Hindutva as RSS. RSS captured power very soon. After the fall of RSS in holding on the state power, Dr Manmohan Singh reincarnated as prime minister and the Bengali Elite caucus led by Pranab Mukherjee and the Marxists mad India a real colony of India.

Cows and bulls have to do nothing in Indian economy these days. You have to buy Cow dung and cow Urine to perform rituals in Indian Villages. In near future, you may have to buy the dust also as indiscriminate Urbanisation and Industrialisation wiped out the Welfare State, democracy, civil and human rights, Constitution of India, sovereignty, indigenous production system, community life, families, individual homes, rural markets, society and social interactions, higher education and research, basic medical care, disciple, behaviour, culture and mother languages with continuous repression of aboriginal and indigenous people, nationalities and displaced refugees! It is defined as the Shining Sensex India which turned out to be a free Hunting Ground for the MNCs. SEZ and Chemical Hubs, Retail Chain and Big dams, Housing and medical complexes, nuclear plants and Industrial areas uproot the Indigenous people mercilessly. Land scape and Human scape in all urban and rural areas have changed thanks to builders and promoters. The Musclemen run the government.

India has become an Infinite Killing Field!

you may visit any Rly station and office complex or any public places and see yourself that cycles have been replaced by Motor Bikes!

How many bikes are bought with hard cash?

In suburbs, the electronic shops are deserted nowadays as the finance is stopped! BSNL is offering Computers with Broad Band.So, it is not necessary to get finance at all. Retail Chains have their own scheme. Due to recovery problems, finance for computers have been stopped.

How many lower middle class people would afford to buy a Personal computer without credit?

The Government is so worried of Petro crisis, but small cars happens to be the topmost priority. Singur Insurrection opens the eyes how consumer Culture replace basic necessity of Food security! Not only Tatas, Salem and other auto industries are pushing investment in auto sector. Infrastructure has become the topmost priority so that the motors could ply on Highways smoothly. I have been in Karnataka and saw , multi lane Highways linking Bangalore with the rural districts. Whenever you stop midway anywhere and if you chose to see teh villages around, you won`t find anything mentionable. No irrigation, no rural development, no drinking water, no employment, no medical care. You have to witness untouchability prevalent. So, prevalent is bonded labour. children, Old and women folk with all the indigenous people face the crisis of existence. But all the media hype is all about the development in Karnataka. All industries were set up in Orissa, Jharkhand and Chhatish Gargh. As it is the same case in Uttarakhand nowadays, Industrialisation and urbanisation is the theme. What happened? Just go there! They have called for Energy Sate Uttarakhand. Nature and natural resources with the human resources always have been the destinations for the Ruling class in the Himalayan Zone. But this time, the ecological and environmental security are on the stake! Despite so much so industrialisation, the aboriginal and indigenous people in Jharkhand, Chhatishgargh and Orissa are the most expolited lot in the world!

You may visit suburban areas and see that private houses have been replaced by housing and market complexes, shopping mall and super markets.

Generation Next has been ousted of the Universities. Equipped with Mobile Phone, Internet and computer, XXX TV channels, Motorbikes and cars with just Twelve plus eligibility with some vocational degree and diploma, they have been thrown into the market sovereign as hawkers and white colored, formally dressed sales agents!

Highly advertised Middle class boom is nothing but Credit Boom. Single credit card is often followed by scores of them. Money is flowing as water and it is not cash. It is credit. In credit, there hardly remains any scope for bargaining. Services have been privatised and we invest our total income for these services only. We have to depend on credit for daily needs. Food security is the most neglected term in India now days as more then seventy Corore of its population face starving conditions.

As BBC reports:

There are growing fears that further rises in Indian interest rates will be needed after inflation hit its highest rate since records began 13 years ago.

Wholesale prices went up by 11.42% in the 12 months to 14 June, which was higher than had been expected.

Earlier in the week, the Reserve Bank of India (RBI) raised interest rates from 8.0% to 8.5% in an attempt to keep inflation under control.

It was the second increase in interest rates in two weeks.

The government has cut duties on items such as crude oil as well as cutting exports of rice to try to keep prices down, but interest rates are still expected to have to go up again.

"We expect inflation to head higher in the coming months and peak somewhere between 12 to 13%," said A Prasanna from ICICI Securities.

"In order to reinforce its policy stance, the RBI will hike rates in the course of the year."

Indian overnight cash rates held steady above 8.5 percent on Friday, on tight cash conditions after last week's quarterly tax outflows and bond auction settlements drained cash from the system.

At 3.05 p.m. call rates <INROND=> were at 8.50/8.60 percent, slightly lower than its previous close of 8.70/8.75 percent.

"There is a shortage of 300 billion rupees in the system, so call rates are expected to stay in a range of 8.75-9.00 percent," a dealer with a private bank said.

Market estimates suggest a total of 350 billion rupees worth of quarterly corporate tax outflows last week, pressuring banks to borrow in the overnight call money market to fund cash requirements.

The central bank also sold 60 billion rupees worth of bonds last week, the cash settlements for which took place on Monday.

The Reserve Bank of India increased its key lending rate and the banks' cash reserve ratio (CRR) by 50 basis points each on Tuesday, to rein in inflation fuelling excess cash from the system.

Dealers said month-end government spending could bring in some inflows but call rates would continue to remain high ahead of the first leg of increase in CRR coming into effect on July 5.

The central bank did not receive any bids at its daily reverse repo auction for the 15th consecutive session while it infused 320.90 billion rupees through its repo auction, indicating the extent of cash squeeze in the system.

We had to eat for energy. We had to wear in a civilised society. These were our basic needs. Later, Education and Medical care were enlisted as our basic necessities. The state was a welfare state and had to ensure continuous supply of these basic necessities. food security was a national concern. For Food security, India opted for Green revolution. We witnessed it as we had Pantnagar University situated only 7 km away which was established in 1960. Then, in late sixties Mrs Indira Gandhi,the most beautiful lady and the most powerful politician emerged as goddess of Socilism and poverty eradictionin 1971. Nehru already opted for soviet model of Development and sidelined the Marxists and communists. Indira directly opted for socialism with nationalisation drive. She was instrumental in liberating Bangladesh.

Since seventies, we felt the heat of development. rural development centred around agro sector. Growth rate and economy was based on agro production. Big dams were introduced. Then Indiafought three wars in between. It was a war with china in 1962. Then, after Nehru`s demise, we saw an Indo Pak War. A war was also fought in 1948 and it was limited in Kashmir. In 1965, this bleeding divided geopolitics witnessed a first full scale war between India and Pakistan. Nehru breathed his last in May, 1964. Pakistan was being ruled by army. General JN Chowdhury won the war. With cease Fire India lost its Prime Minister Lal Bahadur Shastri away in Tashkand, in USSR. Then Mrs gandhi became the prime minister.

Field Marshall Manek Shaw fought a full scale war against pakistan once again and won it. In 1971, India had to intervene in Bangladesh and it was a full scale war. In eighties India also intervened in srilanka , but it was never a war between two nations.

Manek Shaw is no more.

Field Marshal Sam Manekshaw's military acumen apart, his tremendous capability and remarkable quality came out well in the form of the rapport he developed with the political leadership of the time when he led the Army as its chief.

"Manekshaw stood up to the political leadership of that time, be it Prime Minister Indira Gandhi or the entire Cabinet and told them that he needed time to prepare for 1971 war. The rest is history today," Lt Gen Deepinder Singh, who had the privilege of serving the former Army chief as his military assistant between 1969 and 1973, said on Friday.

Condoling the death of Manekshaw at Wellington Military Hospital early Friday, Singh, who wrote a book on the Field Marshal, said: "The rapport developed by Manekshaw with Indira Gandhi and the political leadership and his wisdom prevailing in the 1971 war led to the stature of the entire Army being raised to a high pedestal in the eyes of the nation.

"Manekshaw gave a tremendous amount of dignity to the entire armed forces, particularly in view of the 1962 Indo-Chinese debacle that led to the morale of the defence forces dip to its all time nadir," Singh, who is now settled in Panchkula near Chandigarh, told PTI.

The priorities changed with Indo sino war. Defence came into priority. Nehru initiated diplomatic drive to voice World community and it was a Non Aligned Movement.It supported the Palestine Movement and distanced itself with US Imperialism and Zionist Israel. Indira put emphasise on nonalignment movement though she aligned with USSR to resist US imperialism. With the demise of Mrs Gandhi, nonalignment movement vanished.

With the end of the world community, the Post Modern Manusmriti Apartheid Hindu zionist White Galaxy Order took over.

Priorities changed in the global village. Food security was no more an issue at all. top most priority became Nuclear Armament. Mrs gandhi herself stareted the race with the Smile Of Buddha in Pokaran.War and Civil War became inevitable to feed the Weapon Industry based US Recession economy. We surrendered our sovereignity and the Central cabinet happens to be planted by Washington. Policy decisions are made in the Oval Office. Strategic realiance with US Nuclear Strike Power made Indian Ocean Peace zone the most troubled area as the base of middle east stand off and the so called War against terrorism. The Brahminical ruling Class aligned with zionist Israel.

Hillary Rodham Clinton has already loaned Barack Obama her top fundraisers. Now the former rivals are going to see if she can do the same with voters. When the two Democrats step onstage Friday in New Hampshire, it will be their first joint campaign appearance and their first public display of rapprochement, as they seek to set aside differences and unify the party while helping each other.

Following a private fundraiser with Clinton's top donors in Washington on Thursday, the two were flying together Friday aboard Obama's campaign plane to a rally in Unity, N.H., population 1,700 — a carefully chosen venue in a key general election battleground state.

Aside from the symbolism of its name, Unity awarded exactly 107 votes to each candidate in New Hampshire's first-in-the-nation primary in January. Clinton narrowly won the state's contest, setting in motion an epic coast-to-coast war of attrition between the two candidates that ended June 3, when Obama clinched the nomination. Clinton suspended her campaign four days later.

Obama and Clinton arrived at Reagan National Airport just outside Washington Friday morning at the same time in separate cars, greeting each other on the tarmac with a kiss and a handshake. They sat next to each on the plane as pilots readied for takeoff.

The Unity gathering was the latest and most visible event in a series of gestures the two senators have made in the past two days in hopes of settling the hard feelings of the long primary season. Clinton also praised Obama before two major interest groups Thursday — the American Nurses Association, which endorsed her during the primaries, and NALEO, the National Association of Latino Elected Officials.

Both Democrats badly need one another right now as they move to the next phase of the campaign.

Obama is depending on former first lady to give her voters and donors a clear signal that she doesn't consider it a betrayal for them to shift their loyalty his way. Clinton won convincingly among several voter groups during the primaries, including working class voters and older women — groups that Republican nominee-in-waiting John McCain has actively courted since she left the race.

Clinton, for her part, needs the Illinois senator's help in paying down $10 million of her campaign debt, plus an assurance that she will be treated respectfully as a top surrogate on the campaign trail and at the Democratic Party convention later this summer. Some of her supporters want Clinton's name to be placed in nomination for a roll call vote at the Denver convention, an effort she hasn't formally discouraged.

Thursday, at the Mayflower Hotel in Washington, the New York senator urged about 200 of her top donors and fundraisers — many of whom have been openly critical of Obama's campaign and its perceived slights against Clinton during the primaries — to get behind her erstwhile rival and help him. Obama announced last week he would forgo public financing in the general election, guaranteeing he would need considerable fundraising help in the months to come.

Obama assured the group he would help Clinton retire her debt — an announcement that drew a standing ovation in the room, according to participants. He also wrote a personal check of $4,600 toward that goal — $2,300 each for himself and his wife, Michelle, the maximum allowed under federal law.

"I'm going to need Hillary by my side campaigning during his election, and I'm going to need all of you," Obama said.

He also expressed concern about the sometimes sexist treatment of Clinton during the primary campaign and said Michelle was on the receiving end of such treatment now.

Three top Clinton aides — attorneys Cheryl Mills and Robert Barnett, and longtime confidante Minyon Moore — have been negotiating the details of her future involvement. They've made the case to the Obama campaign that Clinton can spend more time campaigning for him this summer if she isn't working to pay off her debts.

Obama finance chairwoman Penny Pritzker sent an e-mail to the campaign's finance committee Wednesday making a direct pitch.

"Barack has asked each of us to collect five or six checks to help Senator Clinton repay the people who provided goods and services to her campaign," Pritzker wrote. "He made this request in the spirit of party unity. Senator Clinton has promised to do everything she can to help us beat John McCain."

Pritzker also wrote a $4,600 check toward the effort Thursday on behalf of herself and her husband.

Clinton's campaign chairman, Terry McAuliffe, said he would still like to see Obama tap Clinton to be his running mate, but Clinton will campaign hard for her former rival regardless.

"Whatever he decides to do, whatever role for Hillary, she is ready to go, and she will do whatever they ask her to do in the fall campaign," McAuliffe told CNN Friday. "We've done conference calls all over the country to all of our people. 'OK, you know we tried, we gave it everything we had. Now it's time to move forward and support Sen. Obama.' "

Bill Clinton's role in Obama's campaign is still a work in progress, even though he issued a brief statement of support through a spokesman earlier this week.

But McAuliffe told reporters Thursday that the former president was ready to go "24-7" if necessary to help Obama defeat McCain in November.

"He's willing to do whatever it takes. Winning the White House is of paramount importance, not only to Hillary but of course to President Clinton," McAuliffe said.

Indian economy headed for soft landing: Experts

BS Reporter / New Delhi June 26, 2008, 0:03 IST

http://www.business-standard.com/common/news_article.php?leftnm=lmnu2&subLeft=1&autono=327107&tab=r

The Indian economy is headed for a soft landing with tighter monetary policy squeezing growth, several economists said today, a day after the central bank hiked the repo rate and the cash-reserve ratio to ease price pressures and anchor inflationary expectations.

Gross domestic product growth is now expected to moderate to 7.5-7.8 per cent in 2008-09, lower than the previous forecasts of 8-8.5 per cent, they said, predicting a compression in investment and demand growth in the short- to medium-term.

"The economy is headed for a soft landing. The [yesterday's] hike is the single-largest repo rate dose since 2004. Growth will begin to moderate. We now expect GDP growth at 7.5 per cent in financial year 2009, from our earlier forecast of 8.1 per cent," said Shubhada Rao, chief economist, YES Bank.

Since 2005-06, the economy has been growing at 9 per cent and more annually. However, tight monetary regime, high inflation, soaring crude oil prices and instability in the global financial system have heightened fears that growth will moderate this year and going forward.

Last month, Finance Minister P Chidambaram had said he was confident that the economy would grow at not less than 8.5 per cent. However, that seems unlikely, even though the finance ministry today said the Reserve Bank of India's move was to moderate aggregate demand and it augured well for growth.

But several experts said the outlook was not as rosy. Tushar Poddar, vice-president (Asia Economic Research), Goldman Sachs, who had earlier forecast GDP growth rate of 7.8 per cent in 2008-09, today said while the repo rate hike would not have a large negative impact on growth, "there are downside risks to the forecast".

Moody's Economy.com said tighter monetary policy would slow India's economy. "GDP growth is expected to moderate from a breakneck pace of 9 per cent in 2007-08 to a still-impressive 7.6 per cent in the current year," said Sherman Chan, economist at the independent provider of economic analysis and data.

However, there are doubts over the efficacy of the monetary steps in dampening inflation, which the RBI says has been driven up by unrelenting pressure from international commodity prices, particularly crude oil and metals.

"There is little expectation that these measures will have an effect on actual inflation any time soon. Inflation will continue at high levels till the end of the year before coming down by mid-January next," said Saugata Bhattacharya, vice-president, Axis Bank. He is also scaling back the 2008-09 GDP forecast from 7.7-8 per cent to 7.5-7.7 per cent.

From Wikipedia, the free encyclopedia

How credit cards work

| The length of this article or section may adversely affect readability. Please discuss this issue on the talk page, split the content into subarticles, and keep this page in a summary style. |

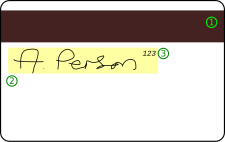

An example of the front of a typical credit card:

- Issuing bank logo

- EMV chip

- Hologram

- Credit card number

- Card brand logo

- Expiry Date

- Cardholder's name

Credit cards are issued after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchants accepting that card.

When a purchase is made, the credit card user agrees to pay the card issuer. The cardholder indicates his/her consent to pay, by signing a receipt with a record of the card details and indicating the amount to be paid or by entering a Personal identification number (PIN). Also, many merchants now accept verbal authorizations via telephone and electronic authorization using the Internet, known as a 'Card/Cardholder Not Present' (CNP) transaction.

Electronic verification systems allow merchants to verify that the card is valid and the credit card customer has sufficient credit to cover the purchase in a few seconds, allowing the verification to happen at time of purchase. The verification is performed using a credit card payment terminal or Point of Sale (POS) system with a communications link to the merchant's acquiring bank. Data from the card is obtained from a magnetic stripe or chip on the card; the latter system is in the United Kingdom and Ireland commonly known as Chip and PIN, but is more technically an EMV card.

Other variations of verification systems are used by eCommerce merchants to determine if the user's account is valid and able to accept the charge. These will typically involve the cardholder providing additional information, such as the security code printed on the back of the card, or the address of the cardholder.

Each month, the credit card user is sent a statement indicating the purchases undertaken with the card, any outstanding fees, and the total amount owed. After receiving the statement, the cardholder may dispute any charges that he or she thinks are incorrect (see Fair Credit Billing Act for details of the US regulations). Otherwise, the cardholder must pay a defined minimum proportion of the bill by a due date, or may choose to pay a higher amount up to the entire amount owed. The credit provider charges interest on the amount owed (typically at a much higher rate than most other forms of debt). Some financial institutions can arrange for automatic payments to be deducted from the user's bank accounts, thus avoiding late payment altogether as long as the cardholder has sufficient funds.

[edit] Interest charges

Credit card issuers usually waive interest charges if the balance is paid in full each month, but typically will charge full interest on the entire outstanding balance from the date of each purchase if the total balance is not paid.

For example, if a user had a $1,000 transaction and repaid it in full within this grace period, there would be no interest charged. If, however, even $1.00 of the total amount remained unpaid, interest would be charged on the $1,000 from the date of purchase until the payment is received. The precise manner in which interest is charged is usually detailed in a cardholder agreement which may be summarized on the back of the monthly statement. The general calculation formula most financial institutions use to determine the amount of interest to be charged is APR/100 x ADB/365 x number of days revolved. Take the Annual percentage rate (APR) and divide by 100 then multiply to the amount of the average daily balance (ADB) divided by 365 and then take this total and multiply by the total number of days the amount revolved before payment was made on the account. Financial institutions refer to interest charged back to the original time of the transaction and up to the time a payment was made, if not in full, as RRFC or residual retail finance charge. Thus after an amount has revolved and a payment has been made, the user of the card will still receive interest charges on his statement after paying the next statement in full (in fact the statement may only have a charge for interest that collected up until the date the full balance was paid...i.e. when the balance stopped revolving).[1]

The credit card may simply serve as a form of revolving credit, or it may become a complicated financial instrument with multiple balance segments each at a different interest rate, possibly with a single umbrella credit limit, or with separate credit limits applicable to the various balance segments. Usually this compartmentalization is the result of special incentive offers from the issuing bank, either to encourage balance transfers from cards of other issuers. In the event that several interest rates apply to various balance segments, payment allocation is generally at the discretion of the issuing bank, and payments will therefore usually be allocated towards the lowest rate balances until paid in full before any money is paid towards higher rate balances. Interest rates can vary considerably from card to card, and the interest rate on a particular card may jump dramatically if the card user is late with a payment on that card or any other credit instrument, or even if the issuing bank decides to raise its revenue.

[edit] Benefits

Because of intense competition in the credit card industry, credit card providers often offer incentives such as frequent flyer points, gift certificates, or cash back (typically up to 1 percent based on total purchases) to try to attract customers to their programs.

Low interest credit cards or even 0% interest credit cards are available. The only downside to consumers is that the period of low interest credit cards is limited to a fixed term, usually between 6 and 12 months after which a higher rate is charged. However, services are available which alert credit card holders when their low interest period is due to expire. Most such services charge a monthly or annual fee.

[edit] Grace period

A credit card's grace period is the time the customer has to pay the balance before interest is charged to the balance. Grace periods vary, but usually range from 20 to 30 days depending on the type of credit card and the issuing bank. Some policies allow for reinstatement after certain conditions are met.

Usually, if a customer is late paying the balance, finance charges will be calculated and the grace period does not apply. Finance charges incurred depend on the grace period and balance; with most credit cards there is no grace period if there is any outstanding balance from the previous billing cycle or statement (i.e. interest is applied on both the previous balance and new transactions). However, there are some credit cards that will only apply finance charge on the previous or old balance, excluding new transactions.

[edit] The merchant's side

For merchants, a credit card transaction is often more secure than other forms of payment, such as checks, because the issuing bank commits to pay the merchant the moment the transaction is authorized, regardless of whether the consumer defaults on his credit card payment (except for legitimate disputes, which are discussed below, and can result in charge backs to the merchant). In most cases, cards are even more secure than cash, because they discourage theft by the merchant's employees and reduce the amount of cash on the premises.

For each purchase, the bank charges the merchant a commission (discount fee) for this service and there may be a certain delay before the agreed payment is received by the merchant. The commission is often a percentage of the transaction amount, plus a fixed fee. In addition, a merchant may be penalized or have his ability to receive payment using that credit card restricted if there are too many cancellations or reversals of charges as a result of disputes. Some small merchants require credit purchases to have a minimum amount (usually between $5 and $10) to compensate for the transaction costs, though this is not always allowed by the credit card consortium.

In some countries, for example the Nordic countries, banks guarantee payment on stolen cards only if an ID card is checked and the ID card number/civic registration number is written down on the receipt together with the signature. In these countries merchants therefore usually ask for ID. Non-Nordic citizens, who are unlikely to possess a Nordic ID card or driving license, will instead have to show their passport, and the passport number will be written down on the receipt, sometimes together with other information. Some shops use the card's PIN code for identification, and in that case showing an ID card is not necessary.

[edit] Parties involved

- Cardholder: The holder of the card used to make a purchase; the consumer.

- Card-issuing bank: The financial institution or other organization that issued the credit card to the cardholder. This bank bills the consumer for repayment and bears the risk that the card is used fraudulently. American Express and Discover were previously the only card-issuing banks for their respective brands, but as of 2007, this is no longer the case.

- Merchant: The individual or business accepting credit card payments for products or services sold to the cardholder

- Acquiring bank: The financial institution accepting payment for the products or services on behalf of the merchant.

- Independent sales organization: Resellers (to merchants) of the services of the acquiring bank.

- Merchant account: This could refer to the acquiring bank or the independent sales organization, but in general is the organization that the merchant deals with.

- Credit Card association: An association of card-issuing banks such as Visa, MasterCard, Discover, American Express, etc. that set transaction terms for merchants, card-issuing banks, and acquiring banks.

- Transaction network: The system that implements the mechanics of the electronic transactions. May be operated by an independent company, and one company may operate multiple networks. Transaction processing networks include: Cardnet, Nabanco, Omaha, Paymentech, NDC Atlanta, Nova, Vital, Concord EFSnet, and VisaNet.[2]

- Affinity partner: Some institutions lend their names to an issuer to attract customers that have a strong relationship with that institution, and get paid a fee or a percentage of the balance for each card issued using their name. Examples of typical affinity partners are sports teams, universities and charities.

The flow of information and money between these parties — always through the card associations — is known as the interchange, and it consists of a few steps.

[edit] Transaction steps

- Authorization: The cardholder pays for the purchase and the merchant submits the transaction to the acquirer (acquiring bank). The acquirer verifies the credit card number, the transaction type and the amount with the issuer (Card-issuing bank).

- Batching: Authorized transactions are stored in "batches", which are sent to the acquirer. Batches are typically submitted once per day at the end of the business day.

- Clearing and Settlement: The acquirer sends the batch transactions through the credit card association, which debits the issuers for payment and credits the acquirer. Essentially, the issuer pays the acquirer for the transaction.

- Funding: Once the acquirer has been paid, the acquirer pays the merchant. The merchant receives the amount totaling the funds in the batch minus the "discount rate," which is the fee the merchant pays the acquirer for processing the transactions.

- Chargebacks: A chargeback is an event in which money in a merchant account is held due to a dispute relating to the transaction. Chargebacks are typically initiated by the cardholder. In the event of a chargeback, the issuer returns the transaction to the acquirer for resolution. The acquirer then forwards the chargeback to the merchant, who must either accept the chargeback or contest it.

[edit] Secured credit cards

A secured credit card is a type of credit card secured by a deposit account owned by the cardholder. Typically, the cardholder must deposit between 100% and 200% of the total amount of credit desired. Thus if the cardholder puts down $1000, he or she will be given credit in the range of $500–$1000. In some cases, credit card issuers will offer incentives even on their secured card portfolios. In these cases, the deposit required may be significantly less than the required credit limit, and can be as low as 10% of the desired credit limit. This deposit is held in a special savings account. Credit card issuers offer this as they have noticed that delinquencies were notably reduced when the customer perceives he has something to lose if he doesn't repay his balance.

The cardholder of a secured credit card is still expected to make regular payments, as he or she would with a regular credit card, but should he or she default on a payment, the card issuer has the option of recovering the cost of the purchases paid to the merchants out of the deposit. The advantage of the secured card for an individual with negative or no credit history is that most companies report regularly to the major credit bureaus. This allows for building of positive credit history.

Although the deposit is in the hands of the credit card issuer as security in the event of default by the consumer, the deposit will not be debited simply for missing one or two payments. Usually the deposit is only used as an offset when the account is closed, either at the request of the customer or due to severe delinquency (150 to 180 days). This means that an account which is less than 150 days delinquent will continue to accrue interest and fees, and could result in a balance which is much higher than the actual credit limit on the card. In these cases the total debt may far exceed the original deposit and the cardholder not only forfeits their deposit but is left with an additional debt.

Most of these conditions are usually described in a cardholder agreement which the cardholder signs when their account is opened.

Secured credit cards are an option to allow a person with a poor credit history or no credit history to have a credit card which might not otherwise be available. They are often offered as a means of rebuilding one's credit. Secured credit cards are available with both Visa and MasterCard logos on them. Fees and service charges for secured credit cards often exceed those charged for ordinary non-secured credit cards, however, for people in certain situations, (for example, after charging off on other credit cards, or people with a long history of delinquency on various forms of debt), secured cards can often be less expensive in total cost than unsecured credit cards, even including the security deposit.

Sometimes a credit card will be secured by the equity in the borrower's home.[3][4] This is called a home equity line of credit (HELOC).

[edit] Prepaid "credit" cards

- See also: Stored-value card

A prepaid credit card is not a credit card,[5] since no credit is offered by the card issuer: the card-holder spends money which has been "stored" via a prior deposit by the card-holder or someone else, such as a parent or employer. However, it carries a credit-card brand (Visa, MasterCard, American Express or Discover) and can be used in similar ways just as though it were a regular credit card.[5][6]

After purchasing the card, the cardholder loads it with any amount of money, up to the predetermined card limit [7] and then uses the card to make purchases the same way as a typical credit card. Prepaid cards can be issued to minors (above 13) since there is no credit line involved. The main advantage over secured credit cards (see above section) is that you are not required to come up with $500 or more to open an account. [8] With prepaid credit cards you are not charged any interest but you are often charged a purchasing fee plus monthly fees after an arbitrary time period. Many other fees also usually apply to a prepaid card.[5]

Prepaid credit cards are sometimes marketed to teenagers[5] for shopping online without having their parents complete the transaction.[9][10][11][12]

Because of the many fees that apply to obtaining and using credit-card-branded prepaid cards, the Financial Consumer Agency of Canada describes them as "an expensive way to spend your own money".[13] The agency publishes a booklet, "Pre-paid cards",[14] which explains the advantages and disadvantages of this type of prepaid card.

[edit] Features

As well as convenient, accessible credit, credit cards offer consumers an easy way to track expenses, which is necessary for both monitoring personal expenditures and the tracking of work-related expenses for taxation and reimbursement purposes. Credit cards are accepted worldwide, and are available with a large variety of credit limits, repayment arrangement, and other perks (such as rewards schemes in which points earned by purchasing goods with the card can be redeemed for further goods and services or credit card cashback).

Some countries, such as the United States, the United Kingdom, and France, limit the amount for which a consumer can be held liable due to fraudulent transactions as a result of a consumer's credit card being lost or stolen.

[edit] Security

Credit card security relies on the physical security of the plastic card as well as the privacy of the credit card number. Therefore, whenever a person other than the card owner has access to the card or its number, security is potentially compromised. Merchants often accept credit card numbers without additional verification for mail order purchases. They however record the delivery address as a security measure to minimise fraudulent purchases. Some merchants will accept a credit card number for in-store purchases, whereupon access to the number allows easy fraud, but many require the card itself to be present, and require a signature. Thus, a stolen card can be cancelled, and if this is done quickly, no fraud can take place in this way. For internet purchases, there is sometimes the same level of security as for mail order (number only) hence requiring only that the fraudster take care about collecting the goods, but often there are additional measures. The main one is to require a security PIN with the card, which requires that the thief have access to the card, as well as the PIN.

An additional feature to secure the credit card transaction and prohibit the use of a lost credit card is the MobiClear solution. Each transaction is authenticated through a call to the user mobile phone. The transaction is released once the transaction has been confirmed by the cardholder pushing his/her pincode during the call.

The PCI DSS is the security standard issued by The PCI SSC (Payment Card Industry Security Standards Council). This data security standard is used by acquiring banks to impose cardholder data security measures upon their merchants.

[edit] Problems

A smart card, combining credit card and debit card properties. The 3 by 5 mm security chip embedded in the card is shown enlarged in the inset. The contact pads on the card enable electronic access to the chip.

The low security of the credit card system presents countless opportunities for fraud. This opportunity has created a huge black market in stolen credit card numbers, which are generally used quickly before the cards are reported stolen.

The goal of the credit card companies is not to eliminate fraud, but to "reduce it to manageable levels".[15] This implies that high-cost low-return fraud prevention measures will not be used if their cost exceeds the potential gains from fraud reduction.

Most internet fraud is done through the use of stolen credit card information which is obtained in many ways, the simplest being copying information from retailers, either online or offline. Despite efforts to improve security for remote purchases using credit cards, systems with security holes are usually the result of poor implementations of card acquisition by merchants. For example, a website that uses SSL to encrypt card numbers from a client may simply email the number from the webserver to someone who manually processes the card details at a card terminal. Naturally, anywhere card details become human-readable before being processed at the acquiring bank, a security risk is created. However, many banks offer systems where encrypted card details captured on a merchant's webserver can be sent directly to the payment processor.

Controlled Payment Numbers are another option for protecting one's credit card number: they are "alias" numbers linked to one's actual card number, generated as needed, valid for a relatively short time, with a very low limit, and typically only valid with a single merchant.

The Federal Bureau of Investigation and U.S. Postal Inspection Service are responsible for prosecuting criminals who engage in credit card fraud in the United States, but they do not have the resources to pursue all criminals. In general, federal officials only prosecute cases exceeding US $5000 in value. Three improvements to card security have been introduced to the more common credit card networks but none has proven to help reduce credit card fraud so far. First, the on-line verification system used by merchants is being enhanced to require a 4 digit Personal Identification Number (PIN) known only to the card holder. Second, the cards themselves are being replaced with similar-looking tamper-resistant smart cards which are intended to make forgery more difficult. The majority of smartcard (IC card) based credit cards comply with the EMV (Europay MasterCard Visa) standard. Third, an additional 3 or 4 digit code is now present on the back of most cards, for use in "card not present" transactions. See CVV2 for more information.

The way credit card owners pay off their balances has a tremendous effect on their credit history. All the information is collected by credit bureaus. The credit information stays on the credit report, depending on the jurisdiction and the situation, for 1, 2, 5, 7 or even 10 years after the debt is repaid.

[edit] Profits and losses

In recent times, credit card portfolios have been very profitable for banks, largely due to the booming economy of the late nineties. However, in the case of credit cards, such high returns go hand in hand with risk, since the business is essentially one of making unsecured (uncollateralized) loans, and thus dependent on borrowers not to default in large numbers.

[edit] Costs

Credit card issuers (banks) have several types of costs:

[edit] Interest expenses

Banks generally borrow the money they then lend to their customers. As they receive very low-interest loans from other firms, they may borrow as much as their customers require, while lending their capital to other borrowers at higher rates. If the card issuer charges 15% on money lent to users, and it costs 5% to borrow the money to lend, and the balance sits with the cardholder for a year, the issuer earns 10% on the loan. This 5% difference is the "interest expense" and the 10% is the "net interest spread".

[edit] Operating costs

This is the cost of running the credit card portfolio, including everything from paying the executives who run the company to printing the plastics, to mailing the statements, to running the computers that keep track of every cardholder's balance, to taking the many phone calls which cardholders place to their issuer, to protecting the customers from fraud rings. Depending on the issuer, marketing programs are also a significant portion of expenses.

[edit] Charge offs

When a consumer becomes severely delinquent on a debt (often at the point of six months without payment), the creditor may declare the debt to be a charge-off. It will then be listed as such on the debtor's credit bureau reports (Equifax, for instance, lists "R9" in the "status" column to denote a charge-off.) The item will include relevant dates, and the amount of the bad debt.[16]

A charge-off is considered to be "written off as uncollectable." To banks, bad debts and even fraud are simply part of the cost of doing business.

However, the debt is still legally valid, and the creditor can attempt to collect the full amount for the time periods permitted under state law, which is usually 3 to 7 years. This includes contacts from internal collections staff, or more likely, an outside collection agency. If the amount is large (generally over $1500 - $2000), there is the possibility of a lawsuit or arbitration.

In the US, as the charge off number climbs or becomes erratic, officials from the Federal Reserve take a close look at the finances of the bank and may impose various operating strictures on the bank, and in the most extreme cases, may close the bank entirely.

[edit] Rewards

Many credit card customers receive rewards, such as frequent flier points, gift certificates, or cash back as an incentive to use the card. Rewards are generally tied to purchasing an item or service on the card, which may or may not include balance transfers, cash advances, or other special uses. Depending on the type of card, rewards will generally cost the issuer between 0.25% and 2.0% of the spend. Networks such as Visa or MasterCard have increased their fees to allow issuers to fund their rewards system. However, most rewards points are accrued as a liability on a company's balance sheet and expensed at the time of reward redemption. As a result, some issuers discourage redemption by forcing the cardholder to call customer service for rewards. On their servicing website, redeeming awards is usually a feature that is very well hidden by the issuers. Others encourage redemption for lower cost merchandise; instead of an airline ticket, which is very expensive to an issuer, the cardholder may be encouraged to redeem for a gift certificate instead. With a fractured and competitive environment, rewards points cut dramatically into an issuer's bottom line, and rewards points and related incentives must be carefully managed to ensure a profitable portfolio. There is a case to be made that rewards not redeemed should follow the same path as gift cards that are not used: in certain states the gift card breakage goes to the state's treasury. The same could happen to the value of points or cash not redeemed.

[edit] Fraud

The cost of fraud is high; in the UK in 2004 it was over £500 million.[17] When a card is stolen, or an unauthorized duplicate made, most card issuers will refund some or all of the charges that the customer has received for things they did not buy. These refunds will, in some cases, be at the expense of the merchant, especially in mail order cases where the merchant cannot claim sight of the card. In several countries, merchants will lose the money if no ID card was asked for, therefore merchants usually require ID card in these countries. Credit card companies generally guarantee the merchant will be paid on legitimate transactions regardless of whether the consumer pays their credit card bill.

[edit] Revenues

Offsetting costs are the following revenues:

[edit] Interchange fee

Bank card associations such as Visa and MasterCard require merchants to pay billions of dollars in Interchange fees to banks that issue their credit and debit cards.[18] Card-issuing banks obtain these interchange fees in addition to the enormous revenue they receive from card holder interest and fees. Interchange fees are the single largest component of the various fees that banks deduct from merchants' credit card sales. Merchants pay their banks fees of 1 to 6 percent of each sale (for large merchants these fees may be negotiated[19], but will vary not only from merchant to merchant, but also from card to card, with business cards and rewards cards generally costing the merchants more to process), which is why many merchants prefer cash, PIN-based debit cards, or even cheques, or will add a percentage to the sale price to cover the interchange fee. Traditionally, interchange fees have been set by the bank card associations and their major card-issuing banks, who are the primary beneficiaries of these fees.[20]

The interchange fee that applies to a particular merchant is a function of many variables including the type of merchant, the merchant's total card sales volume, the merchant's average transaction amount, whether the cards are physically present, if the card's magnetic stripe is read or if the transaction is hand-keyed or entered on a website, the specific type of card, when the transaction is settled, the authorized and settled transaction amounts, etc. For a typical credit card issuer, interchange fee revenues may represent about a quarter of total revenues,[19] but this will vary greatly among credit card issuers. Interchange fees may consume over 50 percent of profits from card sales for some merchants (such as supermarkets) that operate on slim margins. Merchants contend that interchange fees force them to raise prices for everyone; banks contend that interchange fees enable them to offer better cardholder rewards for their best customers.

[edit] Interest on outstanding balances

Interest charges vary widely from card issuer to card issuer. Often, there are "teaser" rates in effect for initial periods of time (as low as zero percent for, say, six months), whereas regular rates can be as high as 40 percent. In the U.S. there is no federal limit on the interest or late fees credit card issuers can charge; the interest rates are set by the states, with some states such as South Dakota, having no ceiling on interest rates and fees, inviting some banks to establish their credit card operations there. Other states, for example Delaware, have very weak usury laws. The teaser rate no longer applies if the customer doesn't pay his bills on time, and is replaced by a penalty interest rate (for example, 24.99%) that applies retroactively. So customers should be wary of these offers, that usually contain some traps.

[edit] Fees charged to customers

The major fees are for:

- Late payments or overdue payments

- Charges that result in exceeding the credit limit on the card (whether done deliberately or by mistake), called overlimit fees

- Returned cheque fees or payment processing fees (eg phone payment fee)

- Cash advances and convenience cheques (often 3% of the amount)[21]. Transactions in a foreign currency (as much as 3% of the amount). A few financial institutions do not charge a fee for this.

- Membership fees (annual or monthly), sometimes a percentage of the credit limit.

- Exchange Rate Loading Fees (May not even appear on your statement!)[22]

[edit] Neutral consumer resources

[edit] Canada

The Government of Canada maintains a database of the fees, features, interest rates and reward programs of nearly 200 credit cards available in Canada. This database is updated on a quarterly basis with information supplied by the credit card issuing companies. Information in the database is published every quarter on the website of the Financial Consumer Agency of Canada (FCAC).

Information in the database is published in two formats. It is available in PDF comparison tables that break down the information according to type of credit card, allowing the reader to compare the features of, for example, all the student credit cards in the database.

The database also feeds into an interactive tool on the FCAC website.[23] The interactive tool uses several interview-type questions to build a profile of the user's credit card usage habits and needs, eliminating unsuitable choices based on the profile, so that the user is presented with a small number of credit cards and the ability to carry out detailed comparisons of features, reward programs, interest rates, etc.

[edit] History

The concept of using a card for purchases was described in 1887 by Edward Bellamy in his utopian novel Looking Backward. Bellamy used the term credit card eleven times in this novel.[24]

The modern credit card was the successor of a variety of merchant credit schemes. It was first used in the 1920s, in the United States, specifically to sell fuel to a growing number of automobile owners. In 1938 several companies started to accept each other's cards.

The concept of paying merchants using a card was invented in 1950 by Ralph Schneider and Frank X. McNamara in order to consolidate multiple cards. The Diners Club, which was created partially through a merger with Dine and Sign, produced the first "general purpose" charge card, which is similar but required the entire bill to be paid with each statement; it was followed shortly thereafter by American Express and Carte Blanche. Western Union had begun issuing charge cards to its frequent customers in 1914.

Bank of America created the BankAmericard in 1958, a product which eventually evolved into the Visa system ("Chargex" also became Visa). MasterCard came to being in 1966 when a group of credit-issuing banks established MasterCharge. The fractured nature of the US banking system meant that credit cards became an effective way for those who were travelling around the country to move their credit to places where they could not directly use their banking facilities. In 1966 Barclaycard in the UK launched the first credit card outside of the US.

There are now countless variations on the basic concept of revolving credit for individuals (as issued by banks and honored by a network of financial institutions), including organization-branded credit cards, corporate-user credit cards, store cards and so on.

In contrast, although having reached very high adoption levels in the US, Canada and the UK, it is important to note that many cultures were much more cash-oriented in the latter half of the twentieth century, or had developed alternative forms of cash-less payments, such as Carte bleue or the EC-card (Germany, France, Switzerland, among many others). In these places, the take-up of credit cards was initially much slower. It took until the 1990s to reach anything like the percentage market-penetration levels achieved in the US, Canada or UK. In many countries acceptance still remains poor as the use of a credit card system depends on the banking system being perceived as reliable.

In contrast, because of the legislative framework surrounding banking system overdrafts, some countries, France in particular, were much faster to develop and adopt chip-based credit cards which are now seen as major anti-fraud credit devices.

The design of the credit card itself has become a major selling point in recent years. The value of the card to the issuer is often related to the customer's usage of the card, or to the customer's financial worth. This has led to the rise of Co-Brand and Affinity cards - where the card design is related to the "affinity" (a university, for example) leading to higher card usage. In most cases a percentage of the value of the card is returned to the affinity group.

[edit] Charga-Plate

The Charga-Plate is an early predecessor to the credit card. They were issued by large-scale merchants, much like department store credit cards of today. In some cases, they were kept in the store. When an authorized user made a purchase, the clerk retrieved the plate from the store's files and then processed the purchase. This made it possible for stores to allow more specialized employees of their customers to use the cards, in addition to corporate officers and executives, who would normally have expense accounts and corporate credit cards. For example, an art-supply store that opened an account with a research institute might allow graphic artists employed by the institute to buy art supplies for ongoing projects. It would not be necessary for the research firm to issue a credit card to the artist: instead, a supervisor would simply say, "Go to Universal Art Supply and buy those supplies." The employee would go to the store and choose the appropriate supplies, and they would be charged to Central Institute for Research's account.

[edit] Collectible credit cards

A growing field of numismatics (study of money), or more specifically exonumia (study of money-like objects), credit card collectors seek to collect various embodiments of credit from the now familiar plastic cards to older paper merchant cards, and even metal tokens that were accepted as merchant credit cards. Early credit cards were made of celluloid, then metal and fiber, then paper and are now mostly plastic.

[edit] Controversy

Credit card debt has soared, particularly among young people. Since the late 1990s, lawmakers, consumer advocacy groups, college officials and other higher education affiliates have become increasingly concerned about the rising use of credit cards among college students. The major credit card companies have been accused of targeting a younger audience, in particular college students, many of whom are already in debt with college tuition fees and college loans and who typically are less experienced at managing their own finances.

A 2006 documentary film titled Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders deals with this subject in detail.[25] The nonprofit group Americans for Fairness in Lending works with Maxed Out to educate Americans about credit card abuse.

Another controversial area is the universal default feature of many North American credit card contracts. When a cardholder is late paying a particular credit card issuer, that card's interest rate can be raised, often considerably. Universal default allows creditors to periodically check cardholders' credit portfolios to view trade, thus allowing the institution to decrease the credit limit or increase rates on cardholders who may be late with another credit card issuer. Being late on one credit card will potentially affect all the cardholder's credit cards. Citibank voluntarily stopped this practice in March 2007 and Chase stopped the practice in November 2007.[26]

Another controversial area is the trailing interest issue. Trailing interest is the practice of charging interest on the entire bill no matter what percentage of it is paid. U.S Senator Carl Levin raised the issue at a U.S Senate Hearing of millions of Americans whom he said are slaves to hidden fees, compounding interest and cryptic terms. Their woes were heard in a Senate Permanent Subcommittee on Investigations hearing which was chaired by Senator Levin who said that he intends to keep the spotlight on credit card companies and that legislative action may be necessary to purge the industry.[27]

In the United States, some have called for Congress to enact additional regulations on the industry; to expand the disclosure box clearly disclosing rate hikes, use plain language, incorporate balance payoff disclosures, and also to outlaw universal default. At a congress hearing around March 1, 2007, Citibank announced it would no longer practice this, effective immediately. Opponents of such regulation argue that customers must become more proactive and self-responsible in evaluating and negotiating terms with credit offerers. Some of the nation's influential top credit card issuers, who are among the top fifty corporate contributors to political campaigns, successfully opposed it.

[edit] Hidden costs

In the United Kingdom, merchants won the right through The Credit Cards (Price Discrimination) Order 1990[28] to charge customers different prices according to the payment method. The United Kingdom is the world's most credit-card-intensive country, with 67 million credit cards for a population of 59 million people.[29]

In the United States, until 1984 federal law prohibited surcharges on card transactions. Although the federal Truth in Lending Act provisions that prohibited surcharges expired that year, a number of states have since enacted laws that continue to outlaw the practice; California, Colorado, Connecticut, Florida, Kansas, Massachusetts, Maine, New York, Oklahoma, and Texas have laws against surcharges.

[edit] Redlining

Credit Card redlining is a spatially discriminatory practice among credit card issuers of providing different amounts of credit to different areas, based on their ethnic-minority composition, rather than on economic criteria, such as the potential profitability of operating in those areas.[30]

[edit] Credit card numbering

The numbers found on credit cards have a certain amount of internal structure, and share a common numbering scheme.

The card number's prefix, called the Bank Identification Number, is the sequence of digits at the beginning of the number that determine the bank to which a credit card number belongs. This is the first six digits for MasterCard and Visa cards. The next nine digits are the individual account number, and the final digit is a validity check code.

In addition to the main credit card number, credit cards also carry issue and expiration dates (given to the nearest month), as well as extra codes such as issue numbers and security codes. Not all credit cards have the same sets of extra codes nor do they use the same number of digits.

[edit] Credit cards in ATMs

Many credit cards can also be used in an ATM to withdraw money against the credit limit extended to the card, but many card issuers charge interest on cash advances before they do so on purchases. The interest on cash advances is commonly charged from the date the withdrawal is made, rather than the monthly billing date. Many card issuers levy a commission for cash withdrawals, even if the ATM belongs to the same bank as the card issuer. Merchants do not offer cashback on credit card transactions because they would pay a percentage commission of the additional cash amount to their bank or merchant services provider, thereby making it uneconomical.

Many credit card companies will also, when applying payments to a card, do so at the end of a billing cycle, and apply those payments to everything before cash advances. For this reason, many consumers have large cash balances, which have no grace period and incur interest at a rate that is (usually) higher than the purchase rate, and will carry those balance for years, even if they pay off their statement balance each month.

[edit] Credit cards as funding for entrepreneurs

Credit cards are a creative, yet often risky way for entrepreneurs to acquire capital for their start ups when more conventional financing is unavailable. It is rumoured that Larry Page and Sergey Brin's start up of Google was financed by credit cards to buy the necessary computers and office equipment, more specifically "a terabyte of hard disks".[31] Similarly, filmmaker Robert Townsend financed part of Hollywood Shuffle using credit cards.[32] Director Kevin Smith funded Clerks in part by maxing out several credit cards. Richard Hatch also financed his production of Battlestar Galactica: The Second Coming partly through his credit cards. Famed hedge fund manager Bruce Kovner began his career (and, later on, his firm Caxton Associates) in financial markets by borrowing from his credit card.

[edit] References

- ^ The TD Gold Travel Visa Cardholder Agreement, Retrieved January 3, 2006

- ^ Reseller Information

- ^ M&I Rewards Equity Card

- ^ TransFund Home Equity Card

- ^ a b c d Credit Cards and You - About Pre-paid Cards. Financial Consumer Agency of Canada. Archived from the original on 2007-03-07. Retrieved on 2008-01-09. document: Pre-paid Cards (pdf). Financial Consumer Agency of Canada. Retrieved on 2008-01-09.

- ^ Prepaid MasterCard® Prepaid Debit Credit Cards & MasterCard Gift Cards MasterCard®

- ^ Get a MasterCard® Gift or General Purpose Prepaid Card MasterCard®

- ^ http://www.fcac-acfc.gc.ca/eng/publications/CreditCardsYou/pdfs/Secured-e.pdf

- ^ http://leeds-faculty.colorado.edu/moyes/bplan/Samples/WallyCard/WallyCard.pdf

- ^ Buy prepaid credit cards without an ID or age limits? … What could go wrong? NetworkWorld.com Community

- ^ PrepaidVisaCard.com.au Bopo Visa prepaid card for teens

- ^ Prepaid Credit Cards

- ^ FCAC - For the Media - News & Speeches - News

- ^ http://www.fcac-acfc.gc.ca/eng/publications/Prepaid/PDFs/Prepaid-e.pdf

- ^ Thrive Business Solutions, http://www.thrivesolution.com/index.php?option=com_content&task=view&id=28&Itemid=33

- ^ Bad Debts and Charge-Offs. Retrieved on 2007-07-12.

- ^ Plastic fraud loss on UK-issued cards 2004/2005 site retrieved 7 July, 2006

- ^ Debit Cards Cash In On Rewards Riches Tampa Tribune, Feb. 15, 2008.

- ^ a b The Interchange Debate: Issues and Economics James Lyon, Jan. 19, 2006.

- ^ United States Securities and Exchange Commission FORM S-1, November 9, 2007.

- ^ Cash Advance Fees. Retrieved on 2007-07-12.

- ^ Gracia, Mike (2008-05-09). credit cards abroad. creditchoices.co.uk. Retrieved on 2008-05-09.

- ^ FCAC - For Consumers - Interactive Tools - Credit Cards and You

- ^ (Chapters 9, 10, 11, 13, 25 and 26) and 3 times (Chapters 4, 8 and 19) in its sequel, Equality

- ^ 'Maxed Out': Serious Matters Of Life and Debt - washingtonpost.com

- ^ http://money.cnn.com/news/newsfeeds/articles/djf500/200712032215DOWJONESDJONLINE000777_FORTUNE5.htm

- ^ Credit Card Executives Tough Out Senate Hearing

- ^ Statutory Instrument 1990 No. 2159: The Credit Cards (Price Discrimination) Order 1990

- ^ The Guardian: Who killed Richard Cullen?

- ^ Cohen-Cole, Ethan, "Credit Card Redlining" (2008). FRB of Boston Quantitative Analysis Unit Working Paper No. QAU08-1 Available at SSRN: http://ssrn.com/abstract=1098403 http://www.bos.frb.org/bankinfo/qau/wp/2008/qau0801.htm

- ^ Google About Page under 1998 page retrieved 30 May, 2007

- ^ Hollywood Shuffle trivia at IMDB page retrieved 7 July, 2006

[edit] See also

- Adverse credit history

- Code 10

- Credit card hijacking

- Credit rating agency

- Credit reference agency

- Dynamic currency conversion, or DCC

- Electronic money

- Fair Credit Reporting Act

- Identity theft

- Merchant account

- Stoozing

[edit] External links

- Choosing and Using Credit Cards - Consumer credit card advice from the Federal Trade Commission

- Avoiding Credit and Charge Card Fraud - More advice from the Federal Trade Commission

- Talk Your Way Out of Credit Debt - NPR Story on how to negotiate with creditors

- Steer Clear in College - NPR story on college credit card debt

- Secret History of the Credit Card - PBS/Frontline/New York Times documentary on credit cards

- Credit Cards at the Open Directory Project

No comments:

Post a Comment